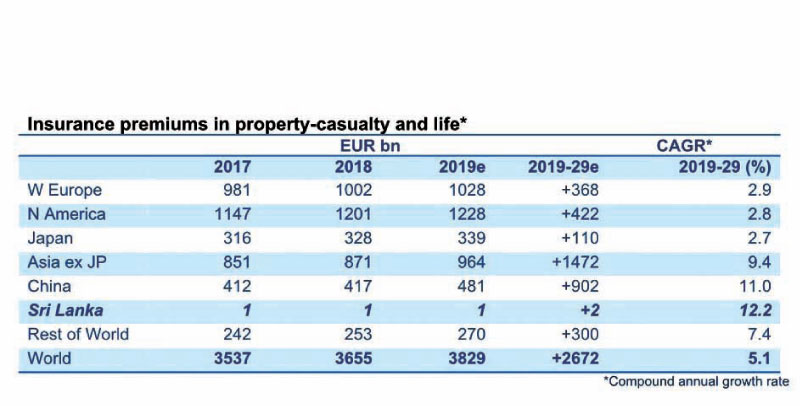

According to projections by Allianz Research, the global insurance premium volume last year rose to 3,655 billion euros (excluding health insurance). Compared to 2017, the nominal in-crease adjusted for exchange rate effects is 3.3%.

Premiums in Sri Lanka grew by 12.1% in 2018, way above the regional average. Also in contrast to most other Asian countries, the total premium pool (without health) is evenly split between property-casualty and life and premiums in both segments increased in perfect sync. For this year, Allianz Research expects a continuation of high growth, with a slight accelera-tion to around 13%.This rapid development with double-digit growth throughout the last two decades notwithstanding, Sri Lanka’s insurance market is still one of the least developed in the region: Premiums per capita stood at EUR 41 in 2018 (below neighboring India with EUR 52) and penetration at 1.1%, which is still the lowest ratio in the region.

Allianz Research expects insurance markets to continue to recover, with global premium growth forecast to reach around 5% in the next decade. Growth expectations for Asia (ex Japan) are notable higher – the region should achieve growth of 9.4% p.a. over the next decade; in Sri Lanka, market growth of 12.2% is foreseen (13.7% in life and 10.6% in p&c). All in all, around 60% of additional premiums will be generated in Asia (ex Japan).

It was the third year in a row (or the 12th out of the last 15 years) that global premium growth lagged behind the expansion of economic activity (+ 5.7% nominal growth in 2018). Insurance penetration (premiums as a percentage of GDP) has thus fallen to 5.4% – the lowest value in the last 30 years.

“It is actually a paradoxical situation,” commented Michael Heise, Chief Economist of Al-lianz SE. “On the one hand, the risks in the world are constantly increasing – just think of climate change, demography, cyber or politics – but on the other hand, people worldwide are spending an ever smaller proportion of their income on insurance. A great joint effort by poli-tics and industry is needed to close this ‘protection gap’.”

It was also an unusual year for Asia: Premiums rose by a meagre 2.3% in Asia (ex Japan), only the second time since the turn of the millennium that it trailed behind global growth. Moreover, with an increase of 4.0%, even Japan grew faster.

The upshot: In 2018, the region accounted for only 16% of global growth (after a whopping 81% in 2017). The global growth engines for 2018 were two old acquaintances: the US (42%) and Japan (11%).

Add new comment